Replace cash with a digital alternative with full control.

With SimpledCard, you get a grip on business spend without the hassle of cash. Your team saves time and you maintain full control.

Spending too much time on petty cash at your locations? Get a grip with SimpledCard.

Petty cash across branches means multiple cash books, daily checks, transporting cash and missing receipts. SimpledCard helps you solve this with digital payment cards that allow your employees to pay without having to advance their own money. So you regain control of on-site spending - without extra work.

Weekly budget

€ 2000,-

You save time on cash checks

Stop cashbooks and day-to-day closures and give your team space for work that matters.

No more lost receipts

No hassle with change and every receipt is recorded directly in the app. So your records always stay complete.

More control, less risk

Real-time insight into spending and not the security risks of cash.

Petty cash costs you more than you think

Your team spends hours on cash checks for relatively small amounts. Receipts get lost and records at your branch remain incomplete. In addition, petty cash entails security risks for your employees. With SimpledCard, you eliminate these hidden costs and provide a smarter solution for your team.

Pay without cash or private card

Your team members no longer need to advance their own money or use private payment cards. They pay directly with their SimpledCard debit card in-store or online and photograph the receipt. No more keeping cash books, or waiting for refunds. So you make small spending per location easy for everyone.

All your expenses automatically in your accounts

Your accounting package such as Exact or AFAS automatically receives all transactions and expense entries. This saves your team hours of manual entry each month and eliminates typos in your records.

What our customers say

Thanks to SimpledCard, we have taken full control of our expenditure management. The real-time insights and automatic approvals save us a lot of time every day and ensure transparency within our team.

All teams now have payment cards to incur expenses. Budgets can be adjusted if required. All cash has now disappeared from the floor. Self-managed teams can effortlessly manage with SimpledCard.

The care teams account for expenses through the app, eliminating the need for us to manually enter hundreds of excel sheets. We can monitor expenditure in real time and intervene if necessary.

Claims are now always made digitally. We are up to date with processing expenses at project level a day later. The reservoir of advances and receipts has dried up thanks to SimpledCard.

How it works.

- 1. Issue smart payment cards to your team

Through the SimpledCard platform, you issue payment cards directly from your own stock. You decide who gets which card and set budgets per person, team or location. Within minutes, your team is ready to make payments.

- 2. Employees pay and photograph the receipt

Employees pay with their card in-store and immediately photograph the receipt via the mobile app or web app. The receipt is automatically linked to the transaction. Simple and always fully documented.

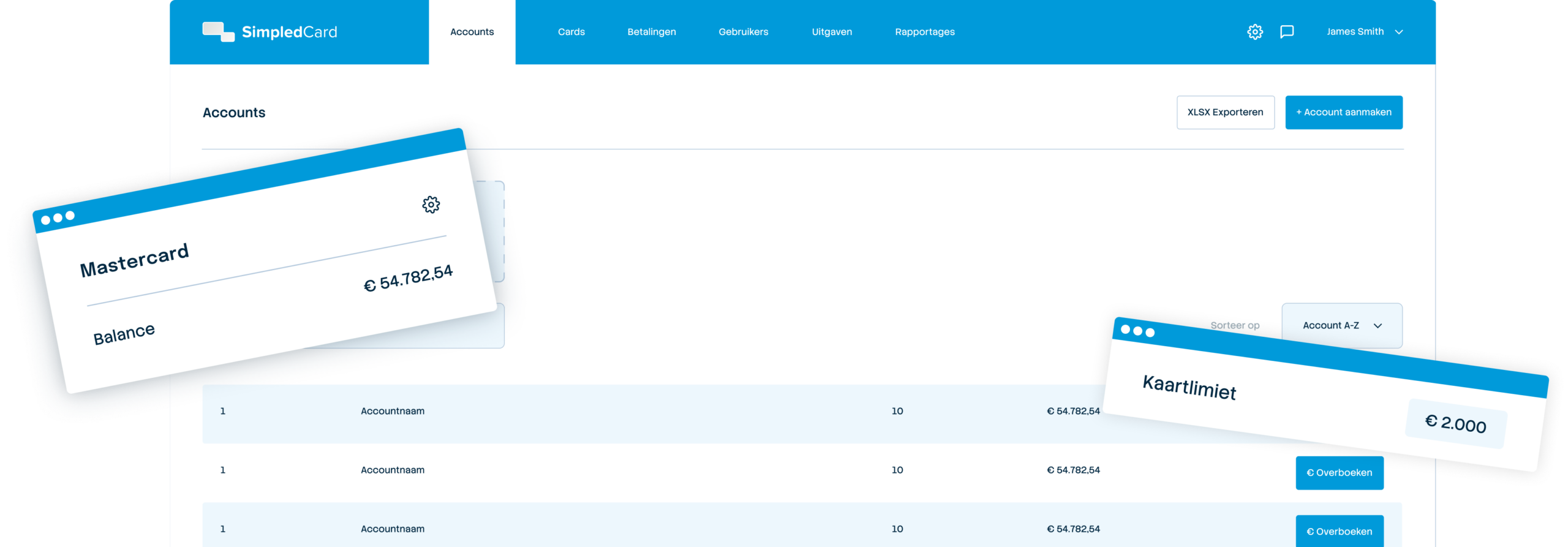

- 3. Manage budgets and limits in real time

In your dashboard, you immediately see where the budgets for each branch are and adjust limits when necessary. Cost reports follow your own approval process. This way, you maintain control and intervene in time in case of deviations.

- 4. All expenses automatically to your accounts

SimpledCard automatically synchronizes with Exact, AFAS or other accounting packages. Transactions, receipts and approved expense reports flow directly through without you or your team having to do anything.

Get started with SimpledCard today

Book a demo and find out how you can replace petty cash on site using SimpledCard.

Finance teams about SimpledCard

Frequently asked questions

- Who is SimpledCard intended for?

SimpledCard was created for finance managers, controllers and CFOs at medium to large organisations. You probably have multiple branches or teams, struggle with cash accounting or expense claims, and want to get a grip on expenses without burdening your team with administration.

- How is SimpledCard different from other solutions?

SimpledCard combines payment cards, spend management and accounting integration in one platform. The business account available through Adyen is covered by the Deposit Guarantee Scheme (DGS). You will work with a dedicated Customer Success Manager who knows your organisation and get support in your own language. Our focus is on the Benelux countries and Germany, where we offer local expertise and personal service.

- Where can employees pay with SimpledCard?

Everywhere Mastercard is accepted. That means in shops, online, and at petrol stations across Europe and worldwide. The cards work the same as regular business payment cards.

- How do I set up approval processes for expenses?

You configure approval workflows by card or issue type. Determine who approves, at what amounts, and whether double approval is required. Approvers receive notifications and can approve directly. The system automatically records who approved what and when for your audit trail.

- Can I allocate expenses to projects or departments?

Yes, you assign each card to a specific cost centre, project or department. Employees can also add additional tags to each transaction themselves. All expenses are automatically categorized. This gives you instant insight into profitability per project or cost structure per department.

- Which accounting systems does SimpledCard integrate with?

SimpledCard integrates directly with Exact Online and AFAS. These are the most widely used accounting systems in the Netherlands. The API links are ready-made and require no technical knowledge to set up. You activate the integration with just a few clicks in the platform. In addition, SimpledCard offers tailor-made reports for all well-known ERP and accounting packages, which you easily import yourself at the end of the month.