PRICING

Spend management that grows with your business.

Each package gives you the control you're looking for. Start small or go straight for extensive features, always with clear prices.

Essential

- Mobile app for receipts with photos and budget limits

- Physical and virtual payment cards from Mastercard

- Real-time transactions and spending overview

- Unlimited number of cost carriers, users and accounts

- Standard reports

- Email, chat and telephone support for administrators

- Onboarding and training

Premium

- All features from Essential

- Automatic cost allocation to cost centre and general ledger

- Batch upload of cost ledger lines

- Multi-step approval of expenditure

- Automatic notifications and reminders for approvals

- Integration with accounting software via custom reports

- Comprehensive reporting and analysis

- Multi-entity management for multiple BVs and entities

- Dedicated support for all users

Enterprise

- All features from Premium

- Custom set up for larger organisations

- Multi-currency support

- Dedicated tailored support

Pricing

Compare our packages

Basic functionality

Workflows & automation

Scalability & customisation

Frequently asked questions

What exactly is SimpledCard?

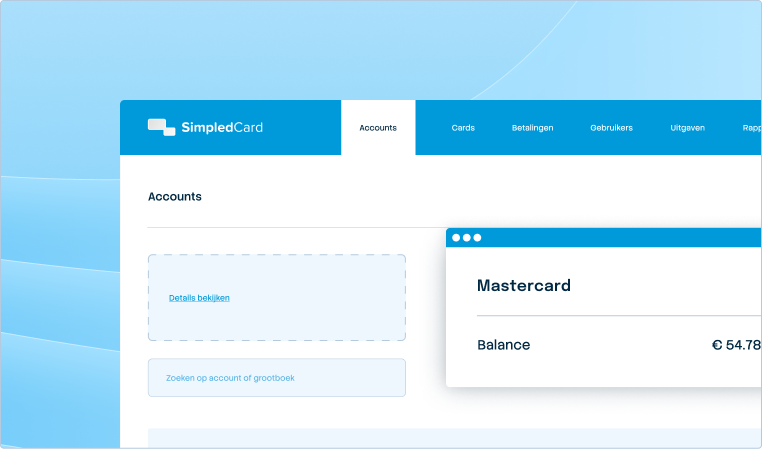

SimpledCard is a spend management platform specifically for medium-sized and large organisations in the Benelux and Germany. You get payment cards for your employees, a clear dashboard to manage expenses, and a direct link to your accounting system. If you opt for a business account through Adyen, you will have your own IBAN available within the SimpledCard platform and can also use it to initiate refunds.

Who is SimpledCard intended for?

SimpledCard was created for finance managers, controllers and CFOs at medium to large organizations. You probably have multiple branches or teams, struggle with cashbooks or expense claims, and want to get a grip on business spend without burdening your team with administration.

Is SimpledCard right for my organisation?

SimpledCard works best for organizations of 100 to 10,000 employees with regular business expenses at different sites or locations. But smaller rapidly deployable teams with large project spend, for example in media production or industrial maintenance, also benefit from SimpledCard.

How is SimpledCard different from my bank?

Your bank offers payment cards. SimpledCard is not a bank itself, but goes further by combining spend management and payments in a smart solution with authorized financial services providers. You set limits per card, instantly see where money goes, and automatically link transactions to your accounting. Employees photograph receipts in the app. You save hours of monitoring and administration.

How is SimpledCard different from other solutions?

SimpledCard combines payment cards, spend management and accounting integration in one platform. The business account available through Adyen is covered by the Dutch Deposit Guarantee Scheme (DGS). Within SimpledCard you work with a dedicated Customer Success Manager who knows your organization and provides support in your own language. Our focus is on the Benelux countries and Germany, where we offer local expertise and personal service.

Why choose SimpledCard over cash and Excel?

Petty cash requires weekly checks, poses security risks and leaves no digital trail. Expense claims via Excel take your team hours to enter, check and approve. With SimpledCard, you automate this completely and save your finance team an average of 12 hours per month.

How does SimpledCard work in brief?

You issue payment cards to employees via the platform and possibly allow them to also submit claims or invoices. For each team, you set budgets and limits. When someone pays, he or she photographs the receipt in the app. The transaction appears directly in your dashboard and syncs automatically with your accounting system such as Exact or DATEV.

How soon can I issue cards to my team?

Virtual cards are ready for use immediately after allocation. Physical cards you stock yourself and assign to employees when needed. This means no more waiting times at banks or complicated application procedures.

What types of payment cards can you use through SimpledCard?

You can choose both physical and virtual Mastercard debit cards. Physical cards are ideal for everyday spending on location. Virtual cards you use for online payments for SaaS subscriptions or supplier payments. You assign both card types directly to employees via the platform.

Where can employees pay with SimpledCard?

Everywhere where Mastercard is accepted. That means in shops, online, and at petrol stations across Europe and worldwide. The cards work the same as regular business payment cards.

How do I avoid unwanted spending with the cards?

You block specific shopping categories per card. You also determine whether ATM withdrawals are possible and set limits for contactless payments. You see every transaction directly in the dashboard with a real-time notification.

Can I set limits and budgets per card?

Yes, you set daily, weekly or monthly limits per card. You determine the maximum amount per person and the total budget for the team. You adjust limits at any time via the dashboard. This way, you keep control without blocking employees in their work.

How do I allocate budget between different cards?

You move budget directly between cards via the dashboard at no extra cost. You do this with one click from your main account to specific cards. This way, you respond flexibly to changing needs without financial penalties or administrative hassle.

What happens if a card is lost or stolen?

The employee immediately blocks the card himself in the app. You also see this in the dashboard and can permanently deactivate the card. Within minutes, you assign a replacement card. The balance remains safe and no unauthorized transaction can take place after blocking.

Can employees manage their own cards?

Yes, employees manage their own card via the mobile app. They can look up their PIN, temporarily block and unblock the card. They also see their transaction history and remaining budget. This reduces support requests to your finance team.

What does SimpledCard solve for my finance team?

Your finance team stops spending so much time on weekly cash checks across branches, manually entering receipts, and chasing people for claims. They get real-time insight into spending by project or department. This creates space for strategic analysis instead of administrative work.

How does submitting receipts through the app work?

Employees photograph the receipt immediately after purchase via the mobile app. The system automatically links the receipt to the correct transaction. The receipt is saved with all transaction details. This means no more lost receipts and complete records for VAT reclaim.

Can I allocate expenses to projects or departments?

Yes, you assign each card to a specific cost centre, project or department. Employees can also add additional tags to each transaction themselves. All expenses are automatically categorized. This gives you instant insight into profitability per project or cost structure per department.

How do I set up approval processes for expenses?

You configure approval workflows by card or issue type. Determine who approves, at what amounts, and whether double approval is required. Approvers receive notifications and can approve directly. The system automatically records who approved what and when for your audit trail.

Do I get real-time insight into all expenses?

Yes, every transaction appears directly in your dashboard as soon as it takes place. You see expenses by employee, project, department or cost centre. You also get real-time notifications on transactions. This allows you to proactively manage budgets instead of correcting afterwards.

How does VAT processing work in SimpledCard?

You enter the VAT amount yourself when you submit the receipt via the app. The system records this and stores the information with the transaction. When exported to your accounting system, the VAT is correctly included, including VAT book number and code. This ensures accurate VAT returns and complete administration.

What happens if an employee does not upload a receipt?

The transaction is marked as incomplete in the system. The employee and his manager automatically receive a reminder. You set the number of days after which reminders are sent. The employee can still add the receipt via the app.

What reports can I create in the platform?

You create customized reports by period, cost centre, project, employee or category. Choose which columns and filters you want to see. Export data to Excel or your BI tool or accounting programme for further analysis. All reports are based on real-time data.

How does the monthly closure with SimpledCard work?

All transactions are already linked to receipts and approved during the month. You export the data with one click to your accounting system such as Exact or DATEV. The general ledger accounts are already correctly allocated. This shortens your month-end closing from days to a few hours.

What does SimpledCard solve for my finance team?

Your finance team stops spending so much time on weekly cash checks across branches, manually entering receipts, and chasing people for claims. They get real-time insight into spending by project or department. This creates space for strategic analysis instead of administrative work.

Which accounting systems does SimpledCard integrate with?

SimpledCard integrates directly with Exact Online and AFAS. These are the most widely used accounting systems in the Netherlands. The API links are ready-made and require no technical knowledge to set up. You activate the integration with just a few clicks in the platform. In addition, SimpledCard offers tailor-made reports for all well-known ERP and accounting packages, such as SAP or DATEV, which you easily import yourself at the end of the month.

How does integration with my accounting system work?

You link SimpledCard once to your accounting system. Our customer support team helps you set up this link. You set up your accounting structure and determine which cost centres and general ledger accounts are used. Then everything is ready to synchronize all your employee expenses directly with your accounting system.

Are general ledger accounts allocated automatically?

Yes, you set once which general ledger accounts and expense types are linked to which categories. SimpledCard uses these rules to automatically assign each transaction the correct general ledger account. This ensures consistent and correct entries without human intervention.

Do I still need to manually enter data after integration?

No, manual entry is no longer necessary. Transactions, expense justifications and VAT information appear automatically in your accounts. You only need to perform occasional control steps. This saves your team considerable time normally spent on expense processing.

What is automatically synchronized?

With the APIs, all transaction data, receipts, VAT information and cost type allocations synchronize automatically. Approval status and any notes on transactions are also included. You get a complete dataset in your accounts without manual entry.

How often does SimpledCard synchronize with my accounts?

Depending on your needs, you can perform the synchronizations daily, weekly or monthly. You decide when to activate the exports. All transactions, expense entries, VAT information and balances are then transferred to your accounting system. With the APIs, you also transfer the receipts immediately.

Does SimpledCard also support integrations other than accounting packages?

Yes, SimpledCard also links with scan and recognition software such as Scan Sys. In addition, you export data to Excel, CSV or other formats for use in BI tools or reporting systems. This gives you flexibility to create analyses in the tools you already use.

How do I export data from SimpledCard?

You generate exports directly from the dashboard with one click. Choose your desired period, filters and export format. The export is ready to download within seconds. You can do this daily, weekly or monthly, depending on your reporting needs.

Is SimpledCard secure?

Security is crucial for SimpledCard. We apply the same level of supervision and regulation as you are used to from regular banks and other payment card providers.

Read more about the PCI certification.

Who provides the business account (*)

SimpledCard itself is not a bank. You can opt for a business account in your organization's name. That business account is provided by Adyen, a recognized financial institution headquartered in Amsterdam. Adyen has a European banking licence and is regulated by De Nederlandsche Bank (relationship number DNB: F0001).

What guarantee does the deposit guarantee scheme offer? (**)

The deposit guarantee scheme (DGS) is a legal safety net designed to protect account holders if a bank can no longer meet its obligations. The implementation of DGS is handled by De Nederlandsche Bank, so for up-to-date and complete information on the DGS, read on to the website of 'De Nederlandsche Bank'. The Dutch deposit guarantee scheme (DGS) has a limit of €100,000 per account holder.

Are all types of organizations covered by the deposit guarantee scheme? (**)

In general, bank and savings accounts of individuals and almost all companies and organizations are covered by the deposit guarantee scheme (DGS), as are business accounts. According to the law, exceptions apply, for example with regard to government organizations and financial companies. Therefore, for more information on the DGS, visit the website of 'De Nederlandsche Bank'.

How do I know if I have a business account or an e-money account?

Please note that just because you transfer money to an IBAN to load your payment cards does not mean it is your own business account. The agreement your organization enters into with the financial services provider will state whether you are taking out a business account and whether the product is eligible for the deposit guarantee scheme.

What is an e-money account?

An e-money account is a payment account issued by an institution with an e-money licence, and not a banking licence. This type of licence was developed by the European legislator to enable competition and innovation in payments. E-money institutions are allowed to offer payment cards and IBANs. An IBAN does not automatically mean a bank account.

E-money accounts are not subject to the deposit guarantee scheme. E-money institutions are required by law to keep funds received separate from equity, for example through a third-party account, under the supervision of De Nederlandsche Bank (DNB).

What is 3D Secure?

3D Secure (also known as ‘Mastercard SecureCode’, ‘Identity Check’ and ‘Verified by Visa’) is a standard that helps to reduce fraud and make your online payments extra secure. Authentication is the process of identifying yourself by sharing secure information available only to you.

How does SimpledCard protect my data?

We are committed to the integrity of personal data. All data is stored in encrypted form on secure servers. We comply with the strict data storage rules laid down by the European Central Bank and Mastercard.

We see it as our duty to continuously keep customer data secure. See our full privacy policy for more details.

How soon can I start using SimpledCard?

After signing the contract, you will immediately start KYC verification with our financial services provider. The turnaround time depends on how quickly you provide the required documentation. After receiving all documents, verification usually takes about 2 working days. Once the verification is complete, our Customer Success team will help you set up the platform in a few days.

What happens after the contract is signed?

Our compliance team will contact you so that you start KYC verification. Our financial service providers are legally obliged to carry out customer verification according to European regulations. You provide them with the necessary documents and will be notified as soon as the verification is completed. After approval, our Customer Success team will help you further with the platform set-up.

What guidance will I receive during implementation?

You will receive personal guidance from our Customer Success team. They will help you set up your cost structure, approval workflows and accounting links. You will have direct contact with a permanent team that gets to know your organization. They will remain your permanent point of contact even after implementation.

Should I train my employees myself?

The mobile app is designed so intuitively that employees can get started right away. However, our Customer Success team can provide a short walkthrough for your team if you want. We also provide instructional materials that you can share. Most employees will master the app within minutes.

How long will the implementation take?

After KYC verification, our Customer Success team will guide you through the set-up and roll-out of the system during implementation meetings lasting about an hour. The total lead time depends on your organizational structure and how much customization you need. Usually, you can be up and running in as little as two weeks.

Can I try SimpledCard with a small team first?

Sometimes it is useful to start with cards or the expense claim module for a specific department or location. That way, you test the solution in practice before rolling it out to the rest of the organization. Our Customer Success team will be happy to think along with you about the best approach.