Give your team payment cards you manage yourself.

Distributing cash, processing claims and arranging bank access takes unnecessary time. With SimpledCard, you issue physical and virtual payment cards that you manage yourself.

Issue payment cards in minutes, not weeks

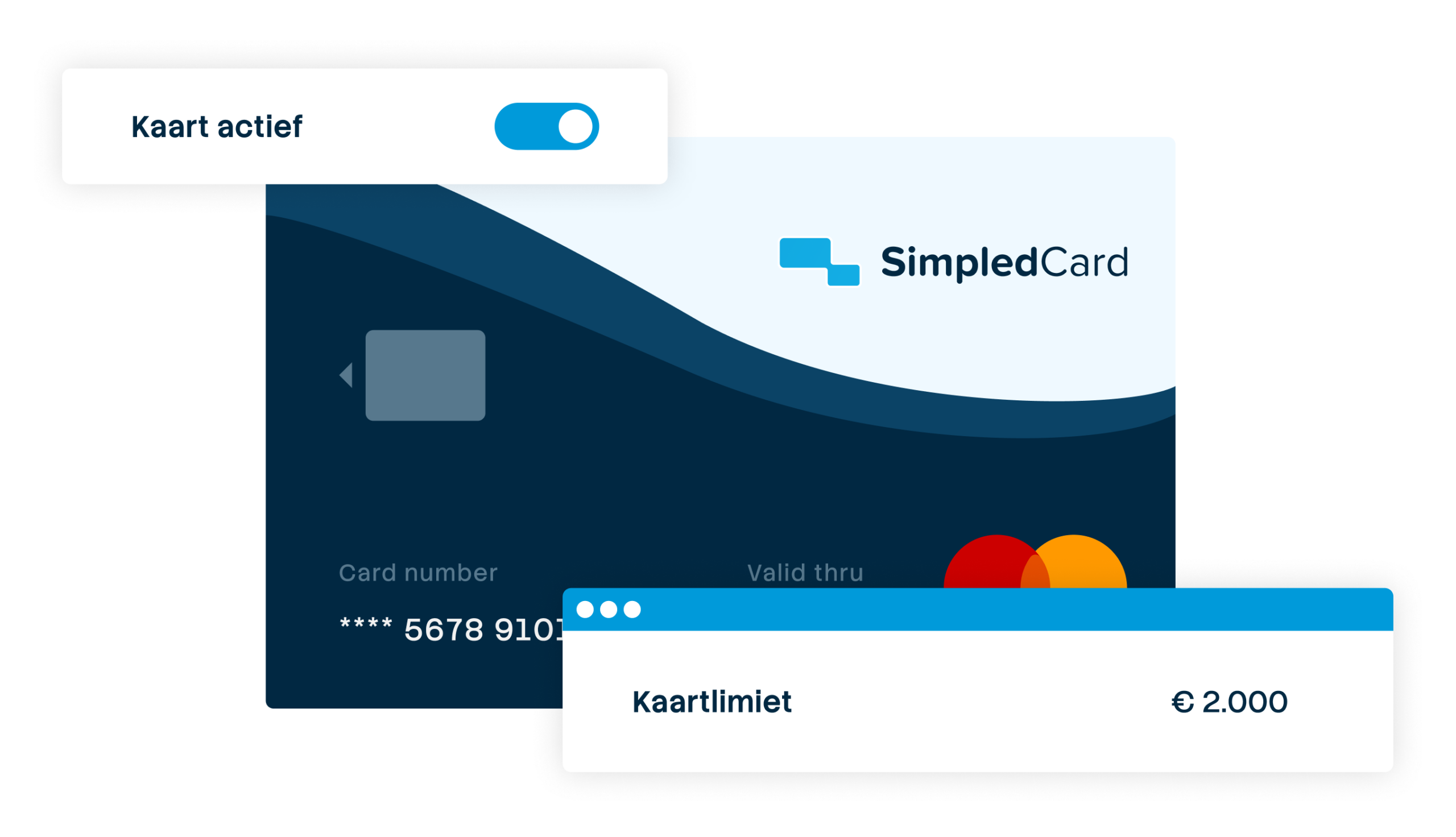

At your bank, it takes weeks to apply for a card, and customization is often not possible at all. With SimpledCard, you issue smart debit cards yourself within minutes. Set limits instantly, decide which shops to pay at and see every transaction in real time. Get a grip on spending without fussing with your bank.

Weekly budget

€ 2000,-

Issued within minutes

No filling in forms or waiting. Assign a card, set a limit and your team pays immediately. Projects start faster, employees don't get stuck.

Physical and virtual

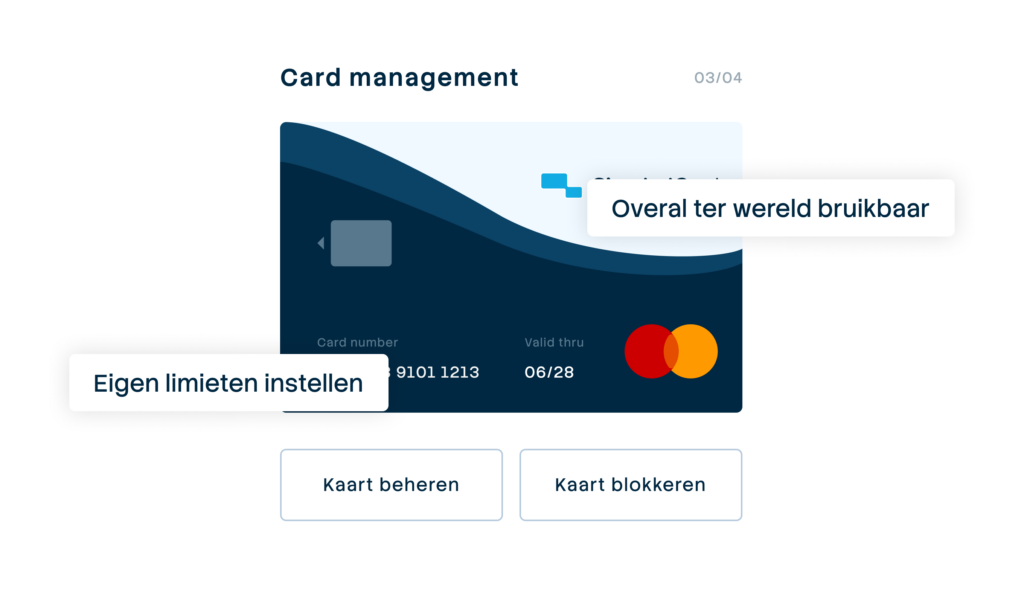

Issue physical cards for on-site spending and virtual cards for online purchases. Accepted worldwide with Mastercard.

You set the rules

Set limits and budgets, block categories and see who has which payment card. That way, you have control over spending without getting in your team's way.

Safer and easier payments for your employees

No more cash, advances or PINs jotted on a note. Your employees pay securely worldwide with smart debit cards. You keep the PIN safe in the mobile app. Internet orders are done with 3D Secure, the global standard for payment authentication. With SimpledCard's combo cards, you benefit from the advantages of Mastercard and Maestro functionality, making it easy to pay anywhere; in shop or online.

Make resources available faster

Assign cards to employees from your own stock within minutes. With smart payment cards you set your own limits and usage rules per card and your team can pay immediately. Adjust limits, block cards or easily assign them to another employee. You see all transactions in real time, replacing cash with one system. Control spending while your team works flexibly. Suitable for payments in multiple currencies, countries and for your different entities.

Confidence through a strong payment network

The payment cards are issued by Adyen. A global payment processor based in Amsterdam, with a European banking licence and an established infrastructure. If you opt for your own business account of Adyen, then eligible balances up to €100,000 are covered by the Dutch Deposit Guarantee Scheme*.

What our customers say

Thanks to SimpledCard, we have taken full control of our expenditure management. The real-time insights and automatic approvals save us a lot of time every day and ensure transparency within our team.

All teams now have payment cards to incur expenses. Budgets can be adjusted if required. All cash has now disappeared from the floor. Self-managed teams can effortlessly manage with SimpledCard.

The care teams account for expenses through the app, eliminating the need for us to manually enter hundreds of excel sheets. We can monitor expenditure in real time and intervene if necessary.

Claims are now always made digitally. We are up to date with processing expenses at project level a day later. The reservoir of advances and receipts has dried up thanks to SimpledCard.

How it works.

- 1. Issue payment cards yourself

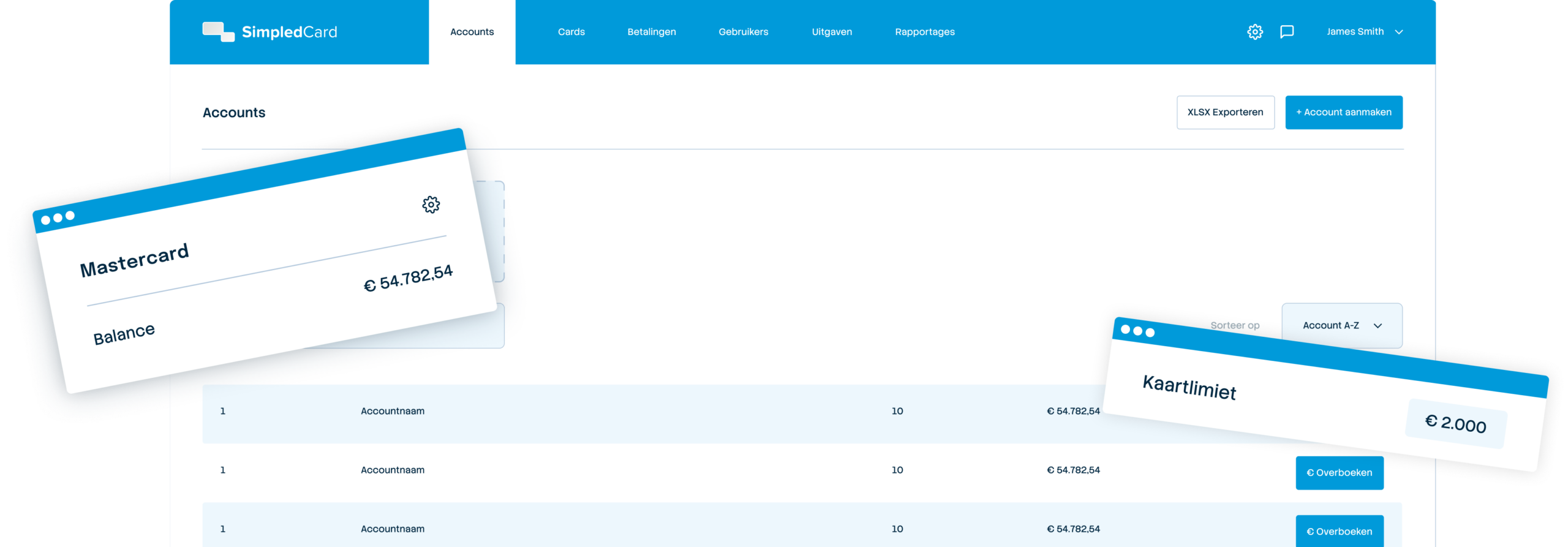

Assign a card from your Card Management System and link it directly to a team, project or location. For physical cards, you give the card to your employee, for virtual cards it appears immediately in the app. Ready to use.

- 2. Set limits and rules

You set a limit per card, decide which shops to pay at and whether cash withdrawals are allowed. Does the situation change? Then adjust the limit with a few clicks. This keeps you in control without employees getting stuck.

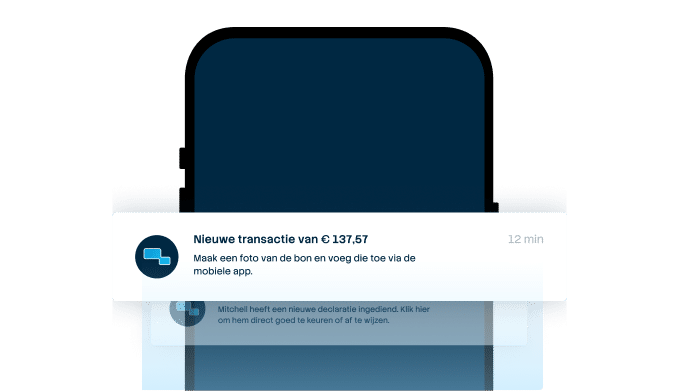

- 3. See every transaction in real time

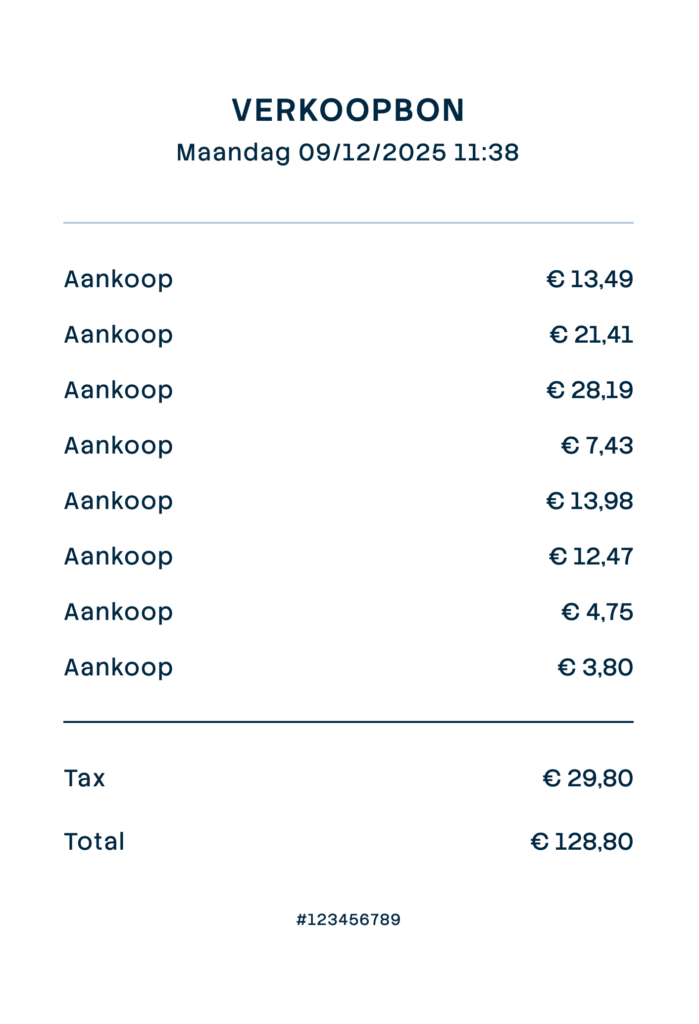

Every payment appears immediately in the platform. You see what has been paid, where and by whom. At the end of the month, no surprises and no searches for lost receipts. Everything is clear and traceable.

- 4. Export directly to your accounting system

Link SimpledCard to AFAS, DATEV or other accounting packages and transactions synchronise automatically. Including VAT splitting, receipt photos and cost centres. So you're done with manual entry.

Get started with SimpledCard today

Book a demo and discover how payment cards from SimpledCard simplify your spend management.

Finance teams about SimpledCard

Frequently asked questions

- What are combo cards and what are the benefits?

The physical combo cards combine Mastercard and Maestro functionality on one card. It allows your employees to pay in-store as well as make online purchases. This means one card for all payment situations. No need to issue separate cards for different types of purchases and your team benefits from global acceptance.

- How do I replace cash with debit cards?

You issue payment cards to teams currently working with cash. For each card, you set a monthly budget that matches their average expenses. Employees now pay with the card and photograph the receipt. You see all transactions directly in the dashboard. In this way, you replace weekly cash controls with one clear system.

- Why is card issuance at SimpledCard easier than at my bank?

At your bank, you have to fill in forms for each new card and wait for approval. That sometimes takes weeks. With SimpledCard, you assign cards yourself directly via the platform. Physical cards you already have in stock and give directly to employees. Virtual cards are active immediately after allocation. You are completely independent of your bank for card issuance.

- Can employees abroad pay with the cards?

Yes, the cards work wherever Mastercard is accepted. This applies across Europe and worldwide. You pay in the local currency and see the transaction immediately reflected in euros in the dashboard. So the cards are suitable for local purchases as well as international branches, business trips and foreign suppliers.

- Can I issue cards by project or location?

Yes, you link each map directly to a specific project, location or team. You do this while assigning the card in the platform. All expenses are automatically linked to the correct cost centre. This gives you instant insight into costs per project or location without manual work.

- How many payment cards can I issue?

The number of cards you can issue depends on your organisation and the arrangements in your contract. In practice, companies issue cards to anyone who makes regular business expenses. These can be dozens or hundreds of cards. Employees who only incur occasional expenses can only be given access to the expense claim module. Contact our team to discuss what suits your situation.

- What happens when an employee changes position?

You simply assign the card to another employee via the platform. The balance and settings are retained or you adjust them to the new position. There is no need to replace the card. This saves time and you don't have inactive cards in circulation.

Your platform for

simple spend management

Settling expense claims in minutes

Employees photograph the receipt and add a short explanation. Process claims in one minute, without paperwork or red tape.

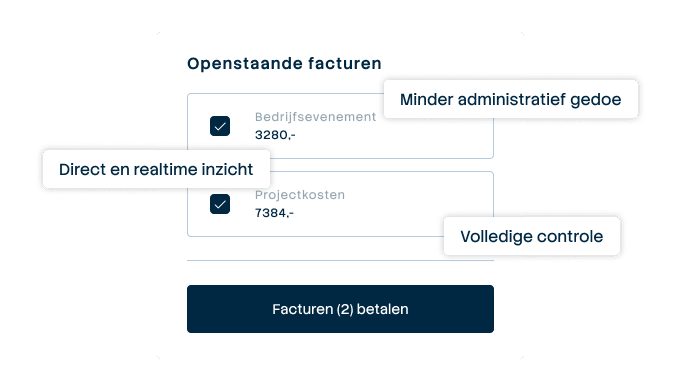

Pay suppliers without hassle, with full control

Upload the invoice, approve it according to your workflow and initiate payment through one transparent flow.

A business account that just works

Choose one or more Dutch IBANs provided by Adyen, linked to all your cards and payment flows. Simple management without complex multi-account structures that cause confusion.

Your central platform for card and expense management

Full control over limits, allowed categories and budgets per employee, team or project. Set rules and let the system enforce them.

From receipt to claim. Wherever you are

Employees arrange their expenses on the go, while the finance team manages everything centrally. For iOS and Android.

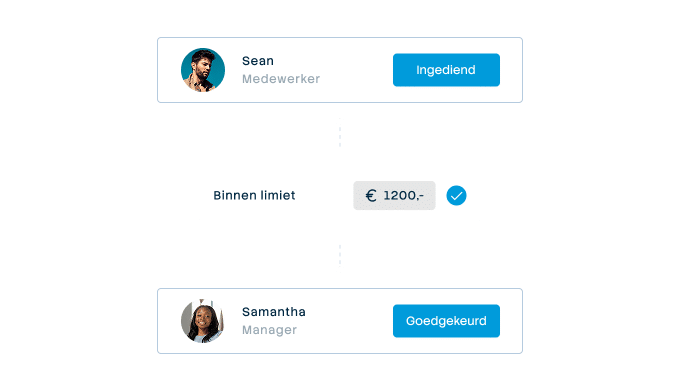

Approval rules that suit your organization

From simple one-step approval to multi-step approval with as many controllers as your organization needs. Configure it once and let the system do the rest.

Always up-to-date insight into your business spend

See immediately where budgets are and which expenses are still outstanding. No more surprises at the month-end, but complete transparency.

Integrate with your systems and automate your administration

Works seamlessly with accounting packages such as AFAS, DATEV and SAP. Transactions automatically synchronize with the correct general ledger accounts.