A business account that just works.

Choose a Dutch business account with your own IBANs and initiate payments of claims and invoices easily from one system. Deposits in your business account are eligible for protection under the Dutch deposit guarantee scheme, up to €100,000.

IBAN payments, simple and hassle-free

Sometimes you just need multiple account numbers so that teams on site can make small payments. But arranging bank access for the right employees is often a hassle. Besides, you do want to know that your funds are held at an authorized financial institution. Choose your own IBANs delivered by Adyen, a recognized financial institution with a European banking licence.

Weekly budget

€ 2000,-

Dutch IBANs

Use one or more Dutch IBANs for different teams or projects. Easy reconciliation without fragmentation across multiple banks, faster monthly closures.

Protection through deposit guarantee scheme

Adyen is a regulated credit institution whose business accounts are eligible for protection under the Dutch Deposit Guarantee Scheme (DGS)**.

Real-time balance and transactions

See your available budget and all ongoing transactions per team or project in one overview. Initiate disbursements of claims and one-off invoices directly from one system via the SimpledCard platform.

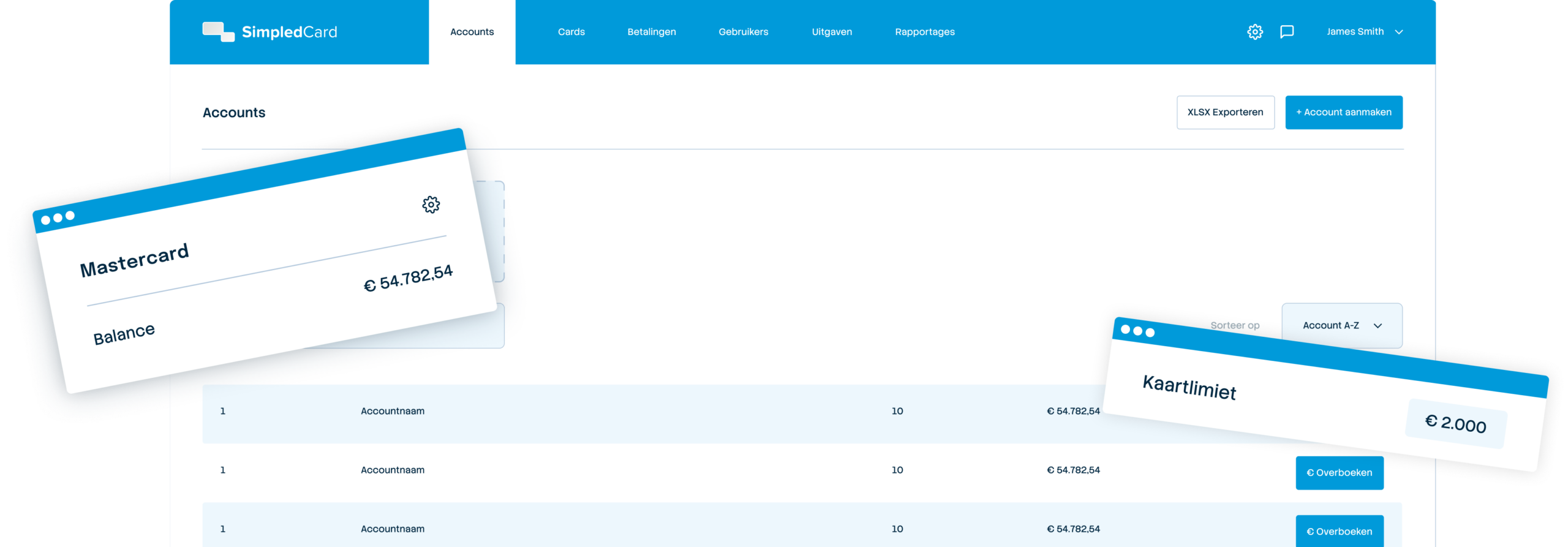

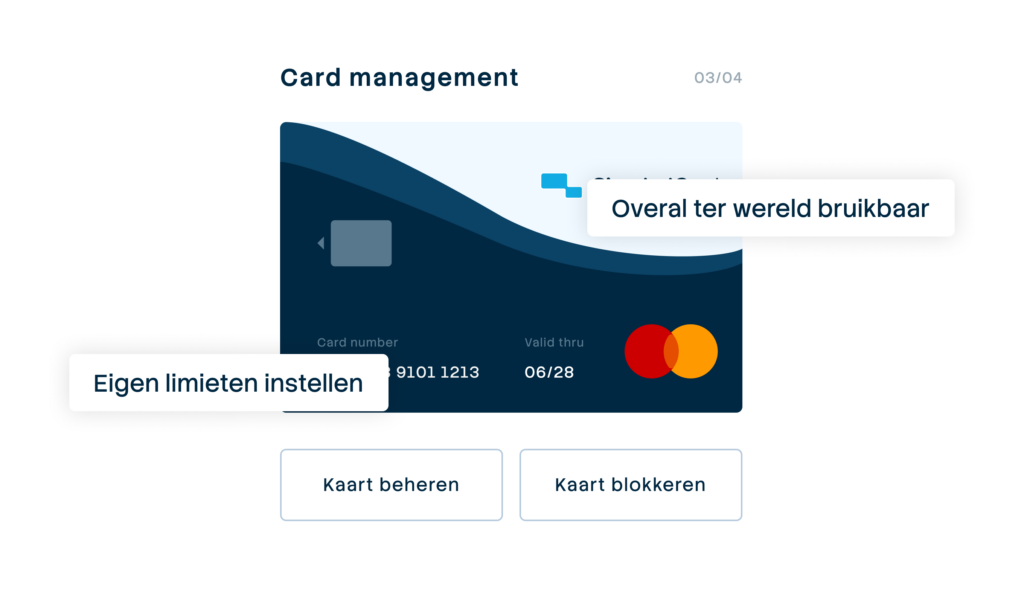

One main account, unlimited flexibility

You make budget available in your own business account* and distribute it within the SimpledCard platform directly to teams, projects or departments. Set limits per card, adjust budgets with a few clicks, and reallocate between teams at no extra cost. In the SimpledCard platform, you always maintain a centralized overview while giving your teams the spending freedom they need.

Dutch Deposit Guarantee: protection of eligible assets

Business accounts provided by Adyen are available to companies registered in the EU. Depending on applicable conditions and regulations, balances in a business account provided by Adyen may be eligible for protection under the Dutch Deposit Guarantee Scheme (DGS), up to €100,000. The deposit guarantee scheme is a statutory safety net designed to protect account holders if a bank can no longer meet its obligations. For current and complete information on the DGS, read on the website of 'De Nederlandsche Bank'.

(Image © De Nederlandsche Bank)

What our customers say

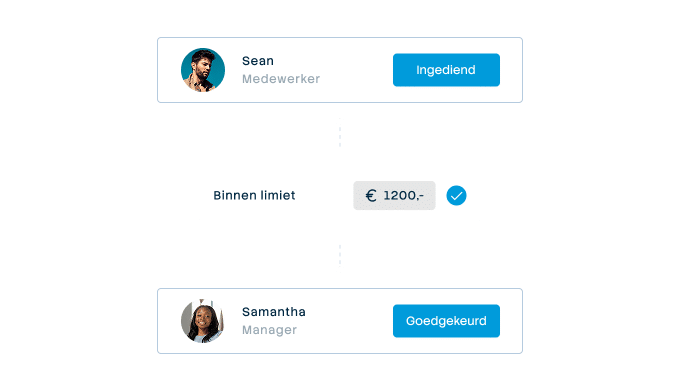

Thanks to SimpledCard, we have taken full control of our expenditure management. The real-time insights and automatic approvals save us a lot of time every day and ensure transparency within our team.

All teams now have payment cards to incur expenses. Budgets can be adjusted if required. All cash has now disappeared from the floor. Self-managed teams can effortlessly manage with SimpledCard.

The care teams account for expenses through the app, eliminating the need for us to manually enter hundreds of excel sheets. We can monitor expenditure in real time and intervene if necessary.

Claims are now always made digitally. We are up to date with processing expenses at project level a day later. The reservoir of advances and receipts has dried up thanks to SimpledCard.

How it works.

- 1. Apply for the business account

Start the application for your own business account*. After the necessary account verification by the financial service provider, you will receive your own Dutch IBAN to which your payment cards will be linked.

- 2. Make balance available and manage your overall budget

You make balance available on your own business account* via a one-time or periodic transfer. As soon as this balance is available, it is available in the SimpledCard platform for distribution across your payment cards. You see in 1 overview how much budget is available and how much of it has been allocated.

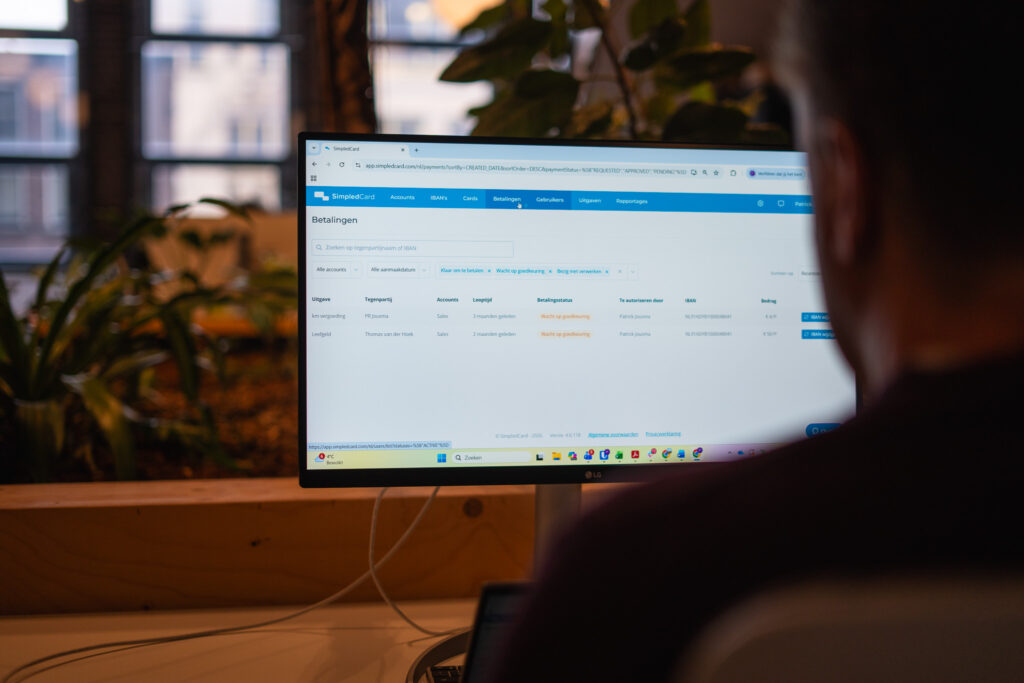

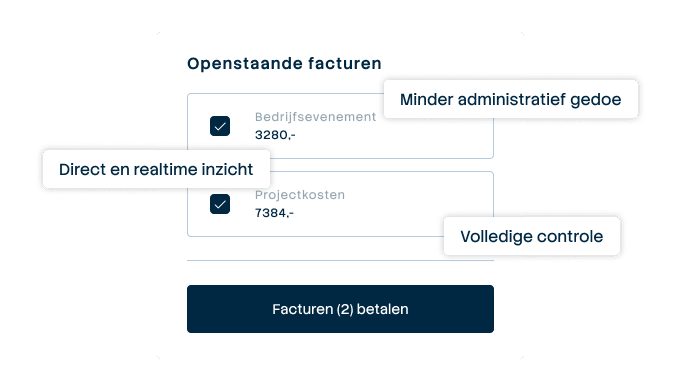

- 3. Claims and one-time invoices easily handled in one system

Employee-submitted claims or one-time invoices go through your own approval process. After approval and IBAN verification of the recipient, you can initiate reimbursements from one of the linked budgets via the SimpledCard platform.

- 4. Export transactions to your accounting system

Export all transactions from your business account directly to your accounting package such as AFAS or Exact Online. Easy reconciliation because everything runs through the SimpledCard API, no more manually merging of data from multiple systems.

No more complicated payments

Discover how your own business account, provided by Adyen, helps you organize your payment processes more easily. Dutch IBAN, insight into budgets and transactions, and no hassle with fragmented accounts or complex reconciliation.

Finance teams about SimpledCard

Frequently asked questions

- Who provides the business account (*)

SimpledCard is not itself a bank. You can opt for a business account in your organization's name. That business account is provided by Adyen, a licenced financial institution headquartered in Amsterdam. Adyen has a European banking licence and is regulated by 'De Nederlandsche Bank' (relationship number DNB: F0001).

- What guarantee does the deposit guarantee scheme offer? (**)

The Deposit Guarantee Scheme (DGS) is a legal safety net designed to protect account holders if a bank can no longer meet its obligations. The implementation of DGS is handled by 'De Nederlandsche Bank', therefore for current and complete information about the DGS, read further on the website of 'De Nederlandsche Bank'. The Dutch deposit guarantee scheme has a limit of €100,000 per account holding company.

- Are all types of organizations covered by the deposit guarantee scheme? (**)

In general, bank and savings accounts of individuals and almost all companies and organisations are covered by the deposit guarantee scheme (DGS), as are business accounts. According to the law, exceptions apply, for example with regard to government organisations and financial companies. Therefore, for more information on the DGS, visit the website of 'De Nederlandsche Bank'.

- How do I deposit money into my business account?

You make a one-off or periodic transfer to your own IBAN at Adyen. As soon as the money is credited, you see the balance immediately in the platform. From then on, you can allocate the budget to payment cards, teams or projects. You decide when and how much you deposit.

- Do I need to have a business account to use SimpledCard?

No, a business account is not required to use debit cards. However, you do need a business account if you want to initiate claim refunds or one-off invoices directly from SimpledCard. Without a business account, you charge cards via transfers to the e-money account of the financial service provider linked to your cards.

- How do I know if I have a business account or e-money account?

Please note that just because you transfer money to an IBAN to balance your payment cards does not mean it is your own business account. The agreement your organisation enters into with the financial services provider will state whether you are taking out a business account and whether the product is eligible for the deposit guarantee scheme.

- What is an e-money account?

An e-money account is a payment account issued by an institution with an e-money licence, and not a banking licence. This type of licence was developed by the European legislator to enable competition and innovation in the payment system. E-money institutions are allowed to offer payment cards and IBANs. In doing so, an IBAN does not automatically mean a bank account.

E-money accounts are not subject to the deposit guarantee scheme. E-money institutions are required by law to keep funds received separate from equity, for example through a third-party account, under the supervision of 'De Nederlandsche Bank' (DNB).

Your platform for

simple spend management

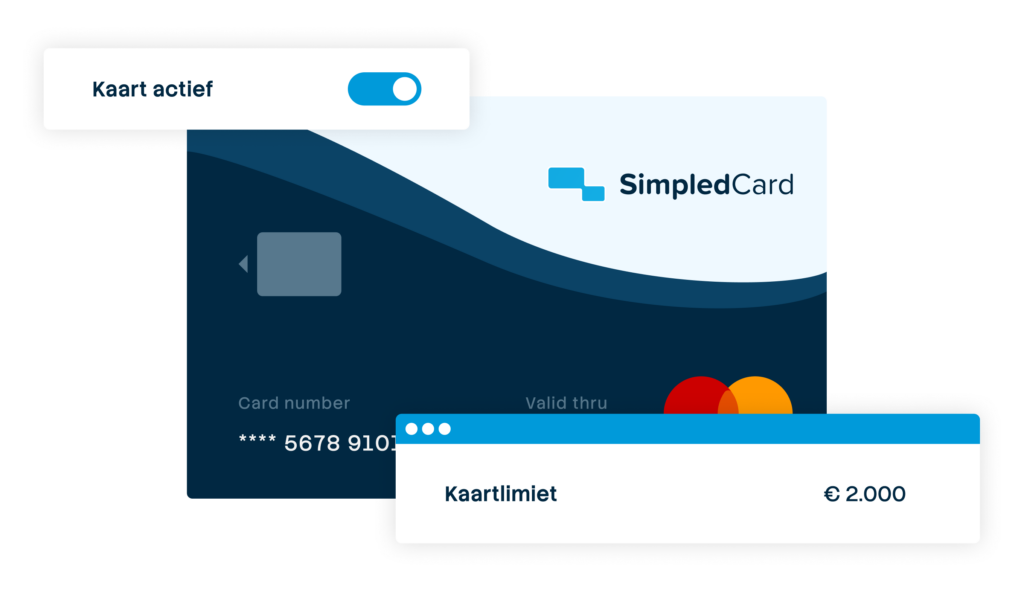

Give your team payment cards you manage yourself

Physical and virtual cards that you issue directly to employees or teams. Replace advances, petty cash and credit cards with one integrated solution.

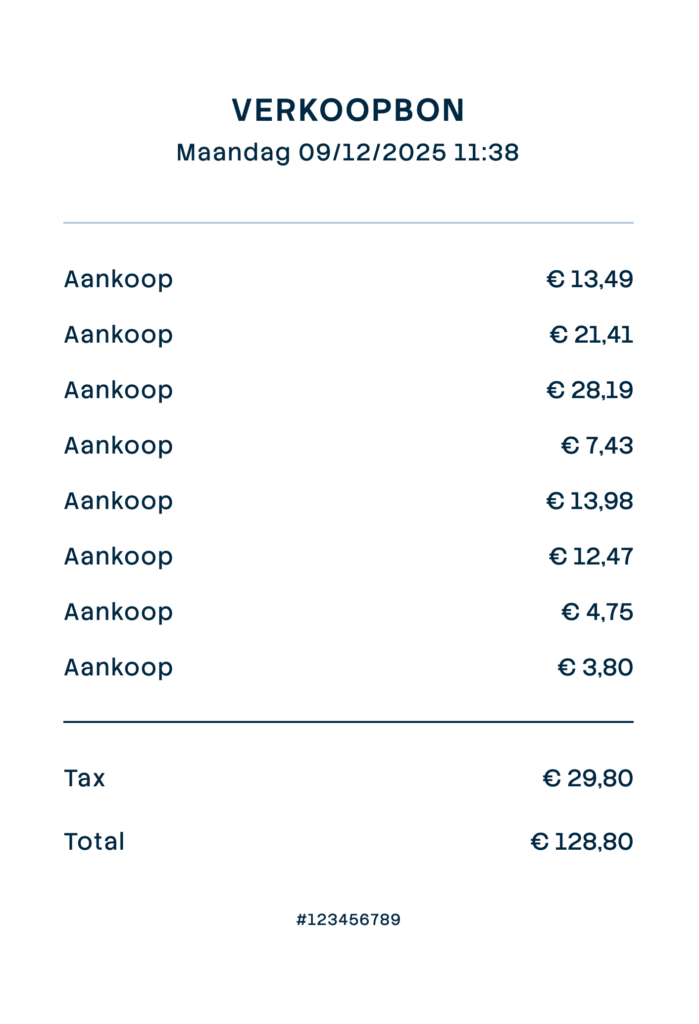

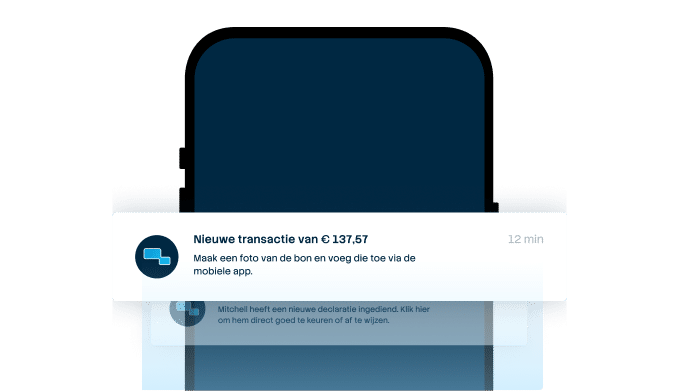

Settling expense claims in minutes

Employees photograph the receipt and add a short explanation. Process claims in one minute, without paperwork or red tape.

Pay suppliers without hassle, with full control

Upload the invoice, approve it according to your workflow and initiate payment through one transparent flow.

Your central platform for card and expense management

Full control over limits, allowed categories and budgets per employee, team or project. Set rules and let the system enforce them.

From receipt to claim. Wherever you are

Employees arrange their expenses on the go, while the finance team manages everything centrally. For iOS and Android.

Approval rules that suit your organization

From simple one-step approval to multi-step approval with as many controllers as your organization needs. Configure it once and let the system do the rest.

Always up-to-date insight into your business spend

See immediately where budgets are and which expenses are still outstanding. No more surprises at the month-end, but complete transparency.

Integrate with your systems and automate your administration

Works seamlessly with accounting packages such as AFAS, DATEV and SAP. Transactions automatically synchronize with the correct general ledger accounts.